How To Grasp The Business Opportunities Of Drinkable Yogurt Market In China?

As consumers’ demands for product health have increased, drinks represented by yogurt have become more and more popular. The major dairy companies are also taking advantage of this opportunity to launch yogurt products with a variety of flavors, packaging, and functions. From the industrial production of yogurt in the 1980s to the present, the Chinese yogurt industry has made rapid progress.

1. The Development of Yogurt Market

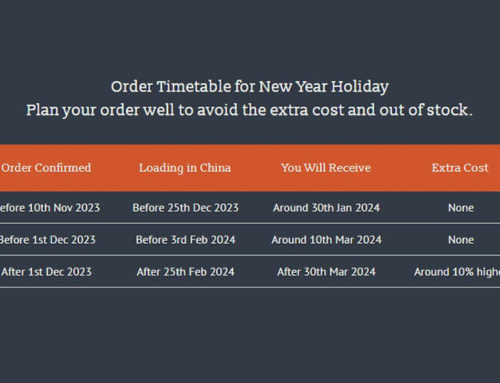

In 2015, the global market capacity of yogurt was about 27.7 billion USD. Then it achieved an increase of 7% in 2016. And in 2017, the overall sales of yogurt exceeded white milk for the first time, accounting for 40% to 50% of the liquid milk industry. It will probably reach 40 billion USD by the end of 2020.

Yogurt subdivides into low-temperature yogurt and room-temperature yogurt. Low-temperature yogurt must generally be stored in the yogurt refrigerator, while room-temperature yogurt doesn’t have to.

In China, low-temperature yogurt has grown steadily, and the growth rate has stabilized at more than 10% during 2011-2016. The room-temperature yogurt just started in 2009, but it has become the most shining star. From 2010 to 2017, the average annual compound growth rate of room-temperature yogurt reached 93.21%.

Sales of Low-Temperature Yogurt in China

Sales of Low-Temperature Yogurt in China

2. Yogurt Is More Attractive to Chinese Consumers than Other Milk Drinks

For every 100 bottles of beverages consumed by Chinese, 22 bottles are milk-containing beverages, including white milk, yogurt, lactic acid bacteria beverages, and other milk-containing beverages. Among these milk-containing beverages, Chinese consumers increasingly prefer to drink yogurt.

The surveys found that the top three reasons for Chinese consumers to choose white milk are: supplementing nutrition, good for health, and loved by children. The reasons to choose yogurt are: promoting digestion, nutrient-rich, and delicious.

Yogurt is becoming more popular, not only because it tastes better than white milk. More importantly, more than 90% of Chinese have more or less allergic reactions to lactose in dairy products, including flatulence and diarrhea. Yogurt products break down a large portion of lactose during fermentation, greatly mitigating possible allergic reactions.

On the other hand, from the perspective of traditional Chinese diet concepts, low-temperature yogurt is not suitable for the two core dairy consumers: children and the elderly. The reason is that they have a weaker gastrointestinal capacity. However, room-temperature yogurt can be introduced to more non-consumers who have been unable to taste low-temperature yogurt in the past and let them access this category. After the two major obstacles of channels and consumers limit were solved, the coverage of yogurt has increased from 30% in the past to nearly 100%.

Sales of Room-Temperature Yogurt in China

Sales of Room-Temperature Yogurt in China

3. Chinese Consumers’ Demand for Yogurt Products Has Been Changing

Chinese consumers have diverse requirements for yogurt products. In the 1990s, Mengniu took the lead in introducing agitated yogurt, which was mainly filled in cups, instead of glass bottles, expanding the sales radius of yogurt. At the same time, flavored yogurt such as jujube yogurt was emerging. So were the plastic cup and spoon type yogurt and fruit yogurt. In recent years, the yogurt mainly based on the appeal of probiotic intestinal function has occupied the mind of consumers. And it has brought product differentiation education based on the concept of strains, linking yogurt with intestinal health that the yogurt can bring the intestinal health while ensuring the taste for the consumers.

In terms of room-temperature yogurt, in 2009, after the launch of Mosilian by Bright, the market responded enthusiastically. Its annual sales rose from 160 million RMB in 2010 to 6.723 billion RMB. In 2016. Mengniu launched Chunzhen in 2013, and Yili launched Anmuxi at the end of 2013. In 2013, the growth rate of sales of room-temperature yogurt in the third and fourth-line cities was 112%, and the growth rate of townships reached 104%. With the twice growth rate of, white milk, the markets of low-line cities and township quickly opened up.

The popularity of room-temperature yogurt also led to large-scale innovation. The three dairy giants are leading the market of room-temperature yogurt, and the products were able to develop rapidly with the advantage of their mature channels, followed by small and medium-sized dairy enterprises. Low-temperature yogurt products are concentrated in the market’s relatively mature sub-categories, such as fruit yogurt or intestinal healthy yogurt. The innovation is more concentrated in the local regional leading dairy enterprises, as well as small and medium-sized dairy enterprises.

4. The Core Drivers of Yogurt Product Innovation

How to stand out in a highly competitive market? Product innovation and upgrade are essential. The first thing to consider is whether the product meets the core factors of driving product innovation in the future:

-

Health Becomes the Primary Concern of Consumers

The proportion of people whose bodies are in the sub-health state has risen from 75% in 2012 to 86% in 2015. Consumers always welcome those products that could solve a particular health problem.

-

Developing towards Cross-over Drinks, Snacks, Desserts and Meal Replacements

Among the main occasions of yogurt consumption, 19% is the breakfast time at home; 16% is the leisure time at home after dinner; 9% is the afternoon in the office, school or other places. Therefore, yogurt products can not only be used for beverage consumption but also can be squeezed into the shortlist of modern consumers’ snacks and desserts. How to take advantage of this and help consumers discover new consumption scenarios will become another core driving force for the continued high growth of yogurt in the future.

-

Income No Longer Determines the Level of Consumption of the Younger Generation

Young people born after 2000 are becoming the main consumer group. Unlike the older generation, the younger generation’s consumption concept no longer directly links to income levels. Consumers are more willing to pay for the daily luxury, explore and experience new ingredients and tastes. And the trend of high-end is imperative.

5. The Trend of Yogurt Product Innovation

Based on the above innovation drivers, the predicted trend of yogurt product in 2019 will be:

-

Drinkable Yogurt Will Be the Dark Horse Among Categories

The sales of drinkable yogurt have grown by 62% in 2011-2016 and will reach 10 billion USD in 2021. And the sales of spoon yogurt were 8.2 billion USD in 2016.

Drinkable yogurt may converge independently into a strong category and compete with scoop yogurt because it is easy for consumers to remember and distinguish. Moreover, drinkable yogurt can be favored by modern consumers in fast-paced fashion in various consumption scenes. For example, in the morning, consumers tend to drink light dairy products. It is also suitable for drinking in restaurants, for example, it can help get rid of the feeling of hot when eating spicy food and this has become a new fashion for young people. Drinking protein-rich yogurt as an energy supplement during exercise is also a rigid demand. In the afternoon tea scene, dessert flavors are also increasingly introduced into yogurt products.

-

Products of Subdivided Markets that Can Meet the Needs of Different Groups of People

With the development of the yogurt market foundation, dairy enterprises will put more product innovation points into the segmentation groups in the future. And the innovation is not only for the taste but more for the needs of the consumer. For example, there is product innovation suitable for children’s growth and nutritional needs, and product innovation for women’s health, slimming and other needs, as well as product innovation for the needs of high-protein and low-sugar of the bodybuilding population.

-

The Trend of High-end Ingredients and Products

The market share of high-end products has already accounted for 12%, and the penetration rate has also reached 33.6%, an increase of 4.2% over 2016. High-end products are particularly highly popular in high-income young families. The high-end trend of yogurt, especially low-temperature yogurt, has always been showing. The price and profit margin of similar yogurt has not only continued to grow, but the high-end categories that have emerged in an endless stream have pushed up the overall average price of yogurt.

From 2012 to 2014, the price of yogurt increased by 13.5% annually, of which 7%-9% came from the launch and popularization of high-end products.